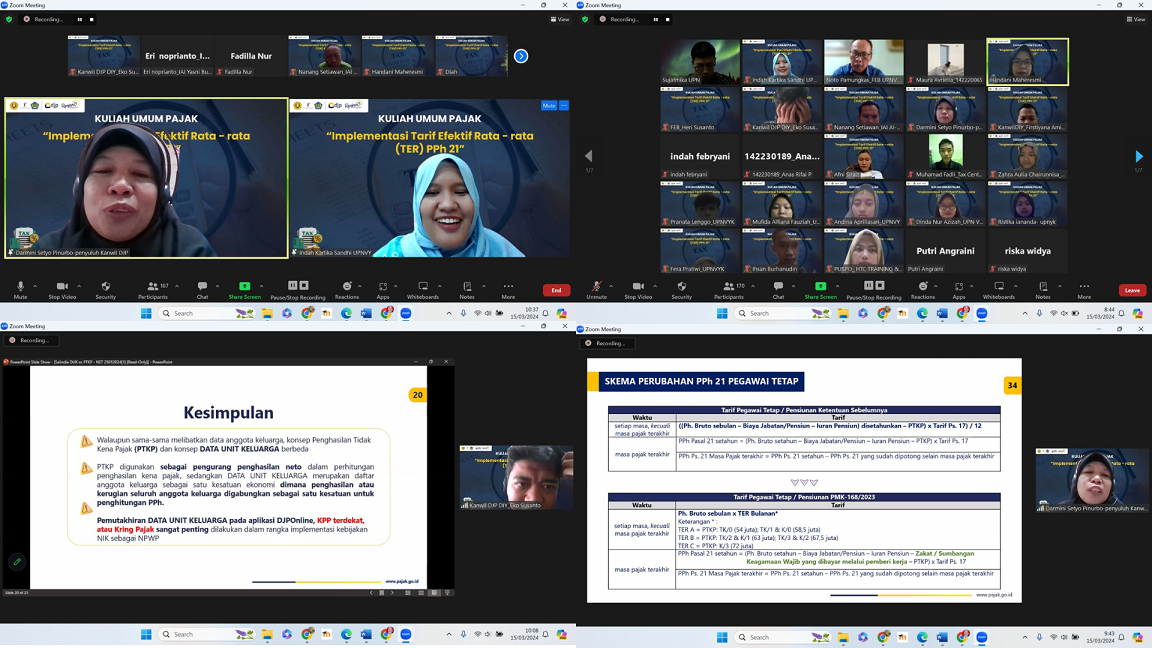

PUBLIC LECTURE ON TAXATION 2024

Tax is one of the largest sources of state revenue. The increase in tax revenue is driven by various tax reform changes carried out by the Ministry of Finance, especially the Directorate General of Taxes. One of the reforms carried out by the Directorate General of Taxes (DJP) is the issuance of Government Regulation No. 58 of 2023 concerning Income Tax Article 21 Withholding Rates on Income Related to Employment, Services, or Activities. The Government, through the Ministry of Finance, facilitates the calculation of Income Tax Article 21 withholding tax (PPh 21) through the implementation of the average effective rate (TER).

In response to the issuance of Government Regulation No. 58 of 2023, the Accounting Department of UPN "Veteran" Yogyakarta and the Tax Center of UPN "Veteran" Yogyakarta organized a Public Lecture on Taxation with the theme "Implementation of the Average Effective Rate (TER) of PPh 21." The Tax Public Lecture featured speakers from the Directorate General of Taxes DIY Regional Office Outreach Team, namely Mrs. Darmini Setio Purbo and Mr. Eko Susanto.

This Tax Public Lecture was conducted online through Zoom meetings and YouTube on Friday, March 15, 2024, from 08:30 to 11:00 WIB (Western Indonesian Time). A total of 193 participants joined, consisting of students, lecturers, and the general public. The participants showed high enthusiasm with interactive discussions. It is hoped that this public lecture will provide participants with an understanding of Government Regulation No. 58 of 2023 and the detailed mechanism for calculating the TER of PPh 21.